Good morning from the sunny side of the grid!

When people talk about solar energy, they usually talk about silicon. Sometimes silver gets a cameo. Rarely copper. Almost never gold. Which is odd—because gold has been sitting quietly inside the clean-energy revolution the entire time. Not as a headline material, not as a cost driver, and not as a "critical mineral" the way lithium or cobalt is. Instead, it serves as something more subtle, more valuable, and harder to replace: a reliability layer.

This article explores how gold is used—sparingly but decisively—in advanced solar technology, why its role is expanding rather than shrinking, and what that means for investors who understand that the energy transition is not just about megawatts, but about durability, efficiency, and trust.

Why Gold Even Matters in Solar (At All)

Gold is not used in solar panels because it's shiny. It's used because it's boring—in the best possible way. Gold conducts electricity extremely well, does not corrode or oxidize, and performs consistently under heat, radiation, vibration, and time. In electronics and energy systems, those traits are priceless.[1]

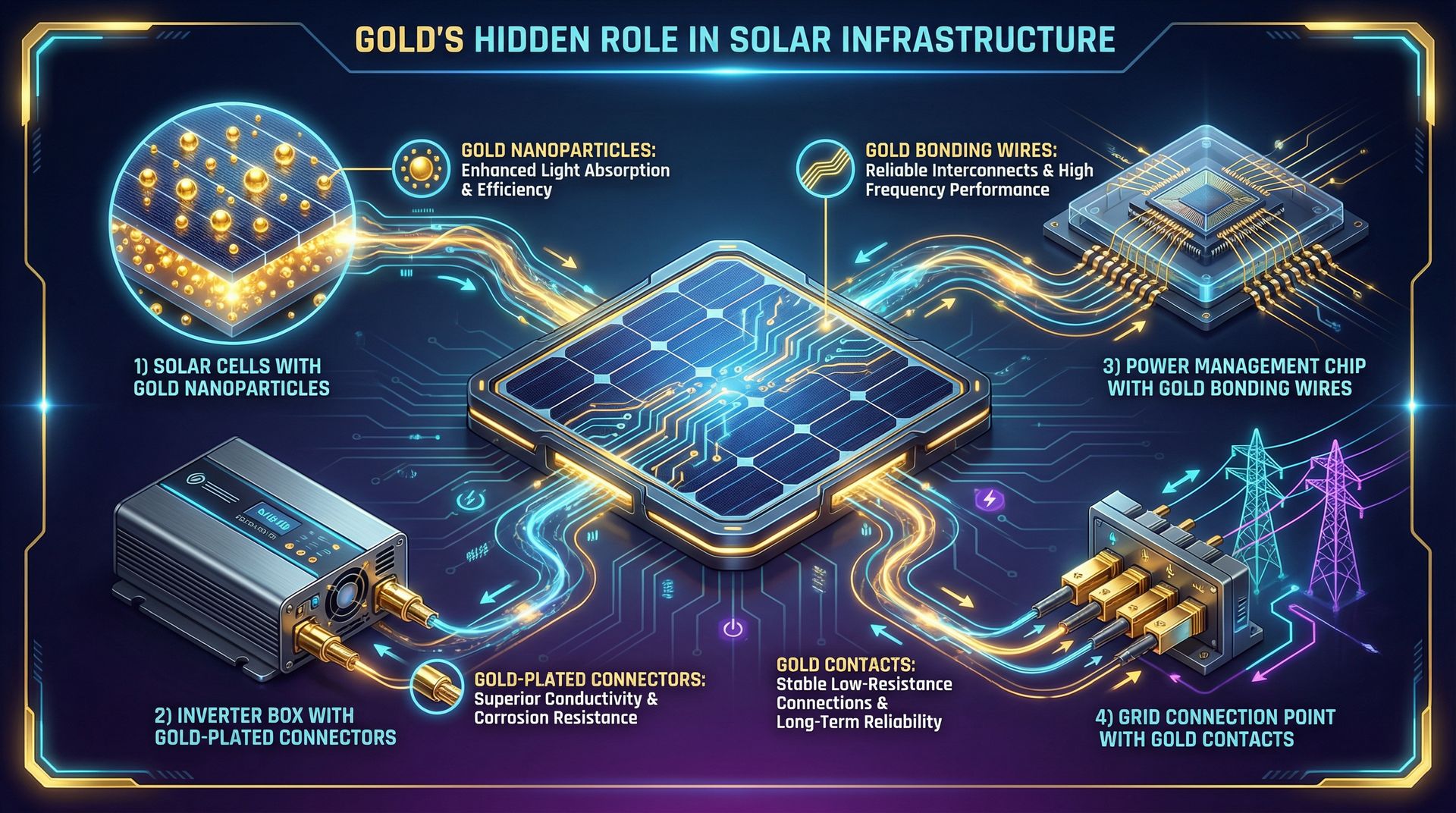

Solar power systems, especially next-generation, high-efficiency systems, are not just panels. They are complex networks of inverters, sensors, power management chips, grid-interface electronics, and long-life connectors exposed to the elements.[2] Every one of those components needs reliability over decades, not years. Gold doesn't degrade. That makes it ideal—in microscopic amounts—for contact points, bonding wires, and specialized coatings where failure is unacceptable. As solar scales globally, component failure becomes the hidden, multi-billion-dollar cost.

The Shift from Cheap Panels to High-Performance Systems

The early era of solar adoption was a race to the bottom, driven by one metric: cost per watt. Today, the calculus has evolved. The focus is now on energy density, system longevity, grid compatibility, storage integration, and maintenance reduction. This evolution changes the material mix. The cheapest possible panel isn't always the most valuable panel over a 25 to 30-year lifespan.

Utilities, governments, and large commercial buyers increasingly prioritize fewer failures, lower downtime, and higher lifetime yield. This is where gold enters the equation—not visibly, but functionally, as a guarantor of long-term performance in the sophisticated electronics that manage and deliver solar power.

Gold in Advanced Solar Cell Design: The Nanoscale Revolution

While most conventional solar cells rely on silicon and silver for current collection, next-generation designs—particularly high-efficiency and experimental cells—increasingly incorporate gold in specialized, high-impact ways.

Perovskite and Tandem Solar Cells: The Stability Challenge

Perovskite solar cells are one of the most promising technologies in solar energy, offering higher theoretical efficiency, lower manufacturing temperatures, and the potential for flexible, lightweight designs. However, they suffer from one major problem: instability. Perovskites degrade when exposed to moisture, heat, and oxygen.

Researchers have found that ultra-thin layers of gold can improve charge collection and act as stable electrodes, significantly reducing degradation.[3] [4] While the National Renewable Energy Laboratory (NREL) is actively researching cheaper alternatives to reduce commercialization costs,[5] gold remains a key material in laboratory settings for proving high-efficiency concepts. As tandem cells (silicon + perovskite) move toward commercialization, gold's role—though tiny per unit—becomes more economically meaningful at scale.

Plasmonic Gold Nanostructures: Bending the Rules of Light

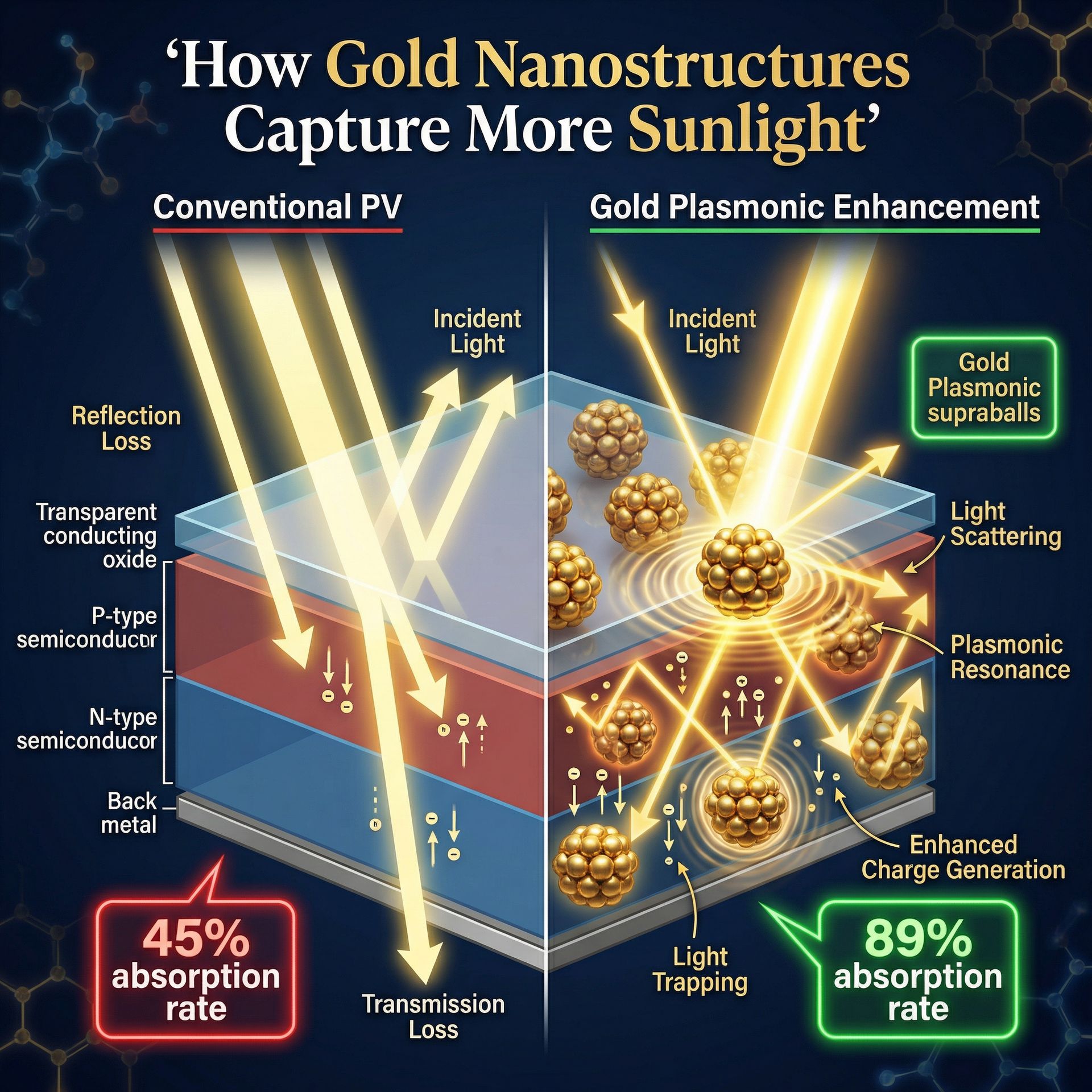

One of the most fascinating developments in solar research involves plasmonics—using metallic nanoparticles to manipulate light. Recent breakthroughs have shown that gold nanoparticles, particularly in complex structures dubbed "supraballs," can trap incoming light, scatter photons into the active layers of a solar cell, and dramatically increase absorption without requiring thicker materials.[6] [7]

In early 2026, researchers reported that these gold supraballs can absorb nearly all wavelengths in sunlight, including some that traditional photovoltaic materials miss.[8] In demonstrations, this new coating technology nearly doubled solar absorption compared to conventional gold nanoparticle films, achieving an average of 89% solar absorption.[9] This is a game-changer for applications where space is at a premium, such as urban solar installations, space-constrained rooftops, and aerospace power systems. Gold's unique optical properties at the nanoscale mean that no cheaper metal behaves quite the same way, giving it a durable, if niche, role in the future of high-efficiency solar cells.

Even if gold never becomes a primary solar cell material in the popular sense, it already plays a crucial, non-negotiable role in the electronics that make solar power usable. Every solar installation relies on inverters, power optimizers, monitoring systems, and grid synchronization hardware.[10] The reliability of these systems depends on gold-plated connectors, gold bonding wires, and gold-coated circuit contacts.[11]

Why? Because failure in these systems causes outages, increases maintenance costs, undermines grid stability, and creates significant regulatory and insurance risks. Studies have shown that wire bond failures alone are responsible for up to 30% of all electronic packaging failures.[12] As solar transitions from a novelty to the backbone of our energy infrastructure, reliability becomes paramount. Gold quietly ensures that reliability.

The Reliability Paradox: Why Gold is Hard to Replace

Engineers constantly try to replace gold, and they always have. Sometimes they succeed—partially. But replacement almost always comes with tradeoffs: higher failure rates, oxidation risk, shorter lifespans, and thermal instability.[13] In mission-critical systems, from aerospace to data centers, gold remains the default choice.

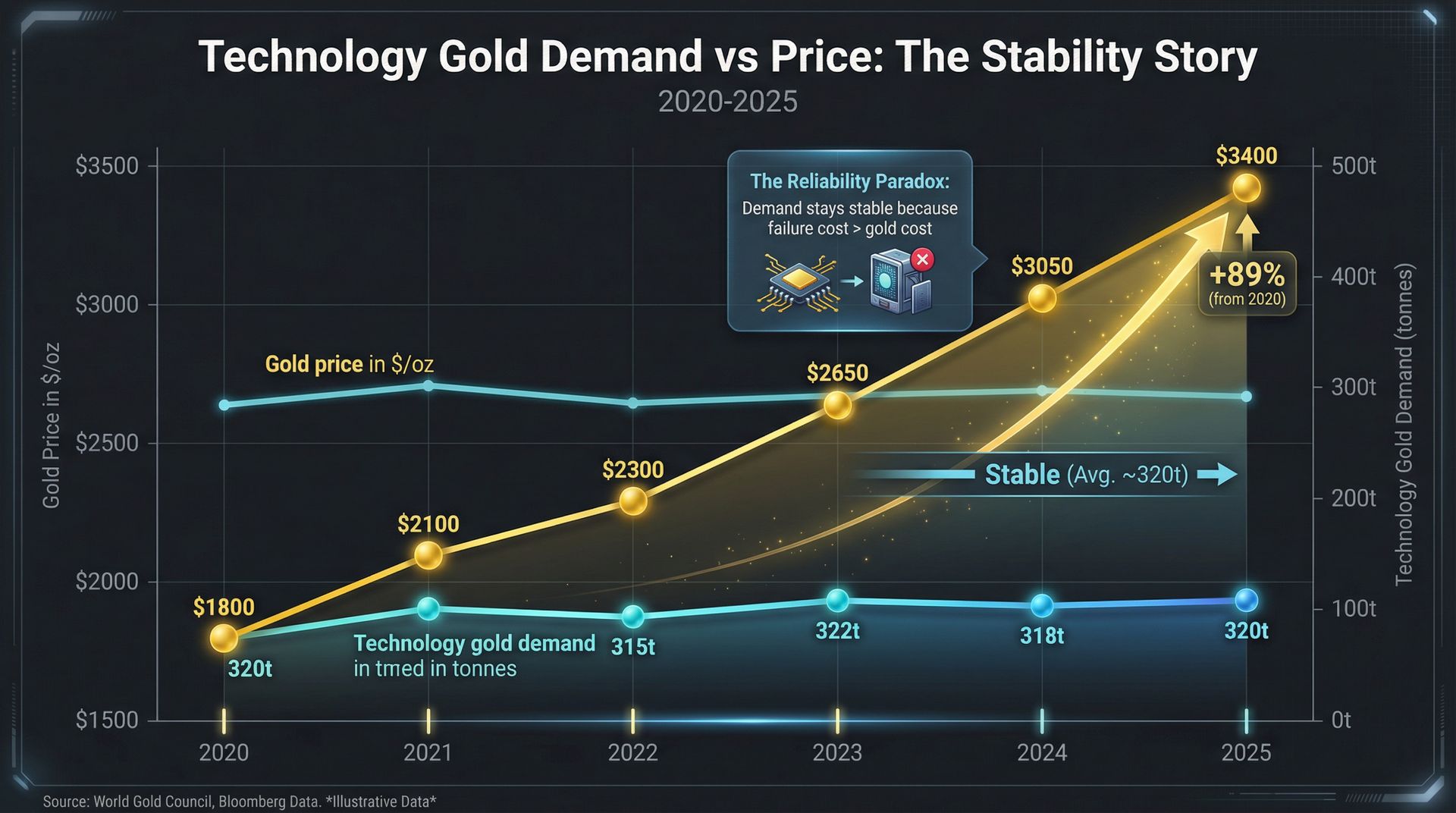

This creates an interesting paradox: gold prices can rise dramatically, but demand for gold in high-reliability energy electronics barely budges. The World Gold Council reported that technology demand for gold remained stable at 322.8 tonnes in 2025, even as the average gold price surged 44% year-over-year to an average of $3,431 per ounce.[14] Why? Because the cost of gold is not the dominant cost; the cost of failure is. For a utility-scale solar farm or a data center powered by solar, the expense of a few milligrams of gold is trivial compared to the cost of an unexpected outage.

Gold Is Not a "Critical Mineral"—And That's a Feature

Unlike lithium, cobalt, nickel, or rare earths, gold is not classified as a critical mineral for the energy transition. This is a hugely important, and often overlooked, feature. Critical minerals face supply bottlenecks, geopolitical risk, nationalization threats, and recycling constraints. Gold, on the other hand, is globally traded, has deep and liquid markets, enormous above-ground stockpiles, and is politically neutral.[15]

This makes gold uniquely attractive as a supporting material in global energy infrastructure. No single nation controls it, no single supply chain dominates it, and no cartel dictates its price. In a world increasingly obsessed with energy security, that neutrality is an invaluable asset.

What This Means Economically: Structural Baseline Demand

The solar transition doesn't create a gold "supercycle." It creates something more subtle and powerful: structural baseline demand that is price-insensitive. Gold demand from the solar and broader clean energy sector is small relative to jewelry or investment, but it is growing with system complexity, is highly resistant to substitution, and is aligned with the multi-trillion-dollar global infrastructure buildout.[16]

This combination doesn't spike prices overnight. It provides a durable, long-term floor for industrial demand, preventing a collapse even in the face of fluctuating investment or consumer sentiment. This is a powerful, stabilizing force for the gold market that is rarely discussed.

The Investment Insight Most People Miss

Gold is usually discussed as an inflation hedge, a crisis asset, or a currency alternative. But its role as an industrial reliability material is quietly expanding, driven by the demands of the energy transition and the rise of artificial intelligence, which requires massive, reliable data centers.[17] This doesn't turn gold into a growth asset. It turns gold into something better: a stabilizer inside a destabilizing global transition.

How to Play It: Second-Order Effect Trades

This thesis can be translated into risk-defined options structures that capitalize on the second-order effects of gold's role in the energy transition. The following are educational examples and not financial advice.

Bullish Spread: Company Benefiting from the Reliability Thesis

Bull Put Spread — First Solar (FSLR)

A company like First Solar (FSLR), which focuses on utility-scale projects and emphasizes durability and long-term performance, is well-positioned to benefit from the shift towards high-reliability systems. As buyers prioritize longevity, First Solar's strong backlog with government and utility contracts makes it a prime candidate.

Example Structure (Earnings-Timed):

•Sell an out-of-the-money put near major support

•Buy a put 5–10% lower for protection

•Expiration: Just after the next earnings report

Thesis: You're betting First Solar stays above key support as long-term demand for high-quality solar infrastructure remains strong. The company benefits from the broader shift toward reliability and performance over pure cost minimization.

Bearish Spread: Company Pressured by the Cost Thesis

Bear Call Spread — Signet Jewelers (SIG)

Conversely, a traditional jewelry retailer like Signet Jewelers (SIG) is highly sensitive to gold prices. As structural industrial demand provides a high floor for gold prices, these retailers face margin pressure and weakening consumer demand. Discretionary luxury purchases become less attractive when input costs remain elevated.

Example Structure (Earnings-Timed):

•Sell an out-of-the-money call above resistance

•Buy a higher-strike call to cap risk

•Expiration: Just after earnings

Thesis: You're betting gold stays expensive enough to pressure margins and limit upside in discretionary luxury retail. The same structural forces supporting gold prices create headwinds for jewelry retailers unable to pass costs through to consumers.

Why This Pairing Works

This pairing works because it isn't a direct bet on the price of gold. It's a trade on its second-order effects: the positive impact of reliability on industrial leaders and the negative impact of high input costs on consumer-facing retailers. Same metal. Different economics.

The Quiet Takeaway

Gold doesn't need to be the star of the solar energy story to matter. It only needs to be trusted, reliable, and irreplaceable at the margin. And that's exactly what it is. The clean-energy future won't glitter, but underneath it all, gold will still be there—doing what it's always done: holding our most critical systems together when everything else is changing.

All the Best and Good Investing!

C.D. Lawrence Senior Energy Analyst Solar Kitties Research

Source Key (Referenced Materials)

This article is based on a comprehensive review of primary research sources, industry reports, academic publications, and market data.

Primary Research & Industry Reports

[1] World Gold Council — Technology Demand Overview

•Gold and Climate Change: The Energy Transition

[2] U.S. Department of Energy — Solar Supply Chain Assessment

•Solar Photovoltaics Supply Chain Deep Dive Assessment (2022 )

[14] World Gold Council — Gold Demand Trends: Full Year 2025

•Technology demand: 322.8 tonnes (stable, -1% y/y )

•Average gold price: $3,431/oz (+44% y/y)

[15] World Bank — Gold Demand in Renewable Energy

•When Uncertainty Rises, Gold Rallies (November 2025 )

[16] Weir Group — A Golden Future: Gold's Role in the Energy Transition

•Gold in solar panels, wind turbines, and renewable infrastructure

[17] World Gold Council — Gold in AI Applications

•You Asked, We Answered: How Important is AI for Gold Demand (November 2024 )

•URL: https://www.gold.org/goldhub/gold-focus/2024/11/you-asked-we-answered-how-important-ai-gold-demand

Academic Research & Technical Publications

[3] ScienceDirect — How Gold Nanoparticles Boost Perovskite Solar Cells

•D. Zheng et al., "How do gold nanoparticles boost the performance of perovskite solar cells?" (2022 )

•1% gold volume concentration yields significant efficiency improvement

[4] ACS Chemistry — Complete Perovskite Solar Cells with Gold Electrodes

•K. Pydzińska-Białek et al., Chemistry of Materials (2022 )

•Study of gold layer thickness and light suppression in perovskite cells

[5] National Renewable Energy Laboratory (NREL ) — Perovskite Research

•"Substitute for Gold Layer in Perovskite Clears Way for Cheaper Commercialization" (June 2023)

[6] MDPI Nanomaterials — Enhanced Solar Efficiency via Plasmonic Gold

•S. Nyembe et al., "Enhanced Solar Efficiency via Incorporation of Plasmonic Gold Nanoparticles" (2022 )

•Efficiency improvement from 2.4% to 6.43% in dye-sensitized solar cells

[7] PMC — Gold Nanostructures/Quantum Dots Review

•A. Phengdaam et al., "Gold nanostructures/quantum dots for the enhanced performance of solar cells" (2024 )

•Comprehensive review showing >30% efficiency improvement vs reference cells

[8] American Chemical Society (ACS ) — Tiny Gold Spheres Research

•"Tiny gold spheres could improve solar energy harvesting" (January 2026)

•Introduction of gold "supraballs" for full-spectrum solar absorption

[9] Phys.org — Gold Supraballs Nearly Double Solar Absorption

•"Gold 'supraballs' nearly double solar energy absorption in demonstrations" (January 2026 )

•89% average solar absorption vs ~45% for conventional coatings

Electronics Reliability & Bonding Wire Research

[10] Pro Plate — Gold Plating for Enhanced Efficiency in Solar Panels

•Gold's role in photovoltaic cell conductivity and electron transfer

[11] California Fine Wire — Advanced Bonding Wire Techniques

•"Unveiling the Future of Electronics With Advanced Bonding Wire Techniques" (June 2024 )

•Gold bonding wires as industry standard for electrical conductivity and reliability

[12] NASA NEPP — Reliability Issues Related to Gold Wire Bonding

•Component failure rate studies showing wire bond failures cause up to 30% of electronic packaging failures

[13] IEEE — Bonding Wire Options and Impact on Product Reliability

•Comparison of gold, copper, and silver wire bonding reliability

Additional Supporting Sources

•Interesting Engineering — "Gold nanoparticles boost solar efficiency by capturing full spectrum" (January 2026 )

•MGS Refining — "How Gold Increases the Efficiency of Solar Panels" (October 2016 )

•Stanford University research on gold in solar panels

•The Assay — "Gold Shining as a Tech Metal"

•Gold as highly efficient substance for light energy absorption

•Al Romaizan — "The Usage of Gold in Technology and What is Beyond" (November 2024 )

•Electronics industry consumes approximately 320 tons of gold annually

•ES Gold — "The Role of Precious Metals in the Green Transition" (June 2024 )

•Gold's role in photovoltaic solar cells and wind energy systems

Disclaimer: This article is for educational and informational purposes only and does not constitute financial advice. The options trading strategies discussed are examples only. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions.